|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Home Rates Today in California: Current Trends and InsightsUnderstanding the current home rates in California is crucial for both prospective buyers and existing homeowners. With fluctuations in the market, it’s essential to stay informed. Current Trends in California Home RatesAs of today, home rates in California show a dynamic landscape influenced by various economic factors. Factors Influencing Home Rates

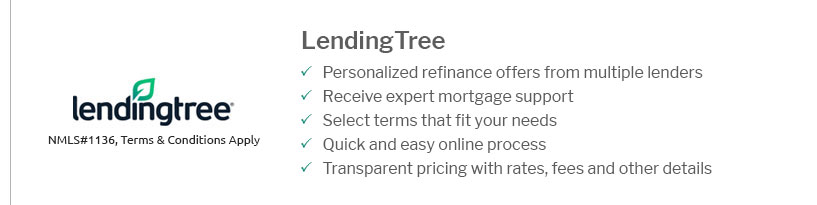

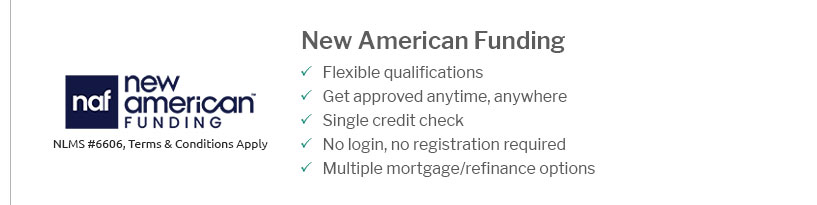

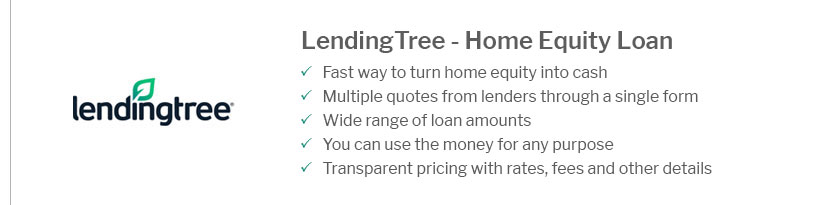

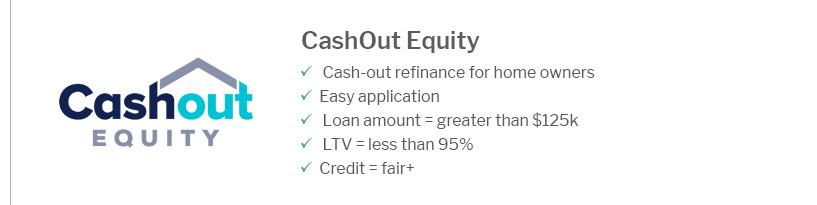

For those looking to refinance, it might be beneficial to explore refinance rate quotes to find the best deals. How to Navigate the Current MarketWith the market's volatility, having a strategic approach is essential for both buyers and sellers. Tips for Homebuyers

Advice for Homeowners

Understanding mortgage loan rates today can also provide valuable insights for making informed decisions. Frequently Asked QuestionsWhat factors are currently affecting home rates in California?Home rates in California are being influenced by economic conditions, government policies, and interest rate changes. How can buyers get the best mortgage rates?Buyers can improve their chances of getting the best mortgage rates by maintaining a good credit score, getting pre-approved, and staying informed about market trends. Is it a good time to refinance my home in California?This depends on current interest rates and your financial situation. It may be beneficial if current rates are lower than your existing mortgage rate. https://www.redfin.com/todays-mortgage-rates/california

On Wednesday, March 26, 2025, the average APR in California for a 30-year fixed-rate mortgage is 6.763%, a decrease of 3 basis points from a week ago. https://www.calbanktrust.com/personal/home-loans/mortgage-rates/

Loan amount of $355,000.00, advertised APR of 6.037% fixed for 15 years and payment is $2,947.96. The loan scenario above is for example purposes only. Monthly ... https://www.sofi.com/mortgage-rates-in-california/

Mortgage rates in California have trended lower than the national average for decades, and economists predict they'll be dropping further into 2025.

|

|---|